By: Danny Parish As of 2010, Americans who were 65 years of age or older represented 13 percent of the total U.S. population.[1] By the year 2030, this population is expected to grow to 19.3 percent of the population. Americans who have reached retirement age are one of the fastest growing demographics in this Country. … Read More

By: Danny Parish

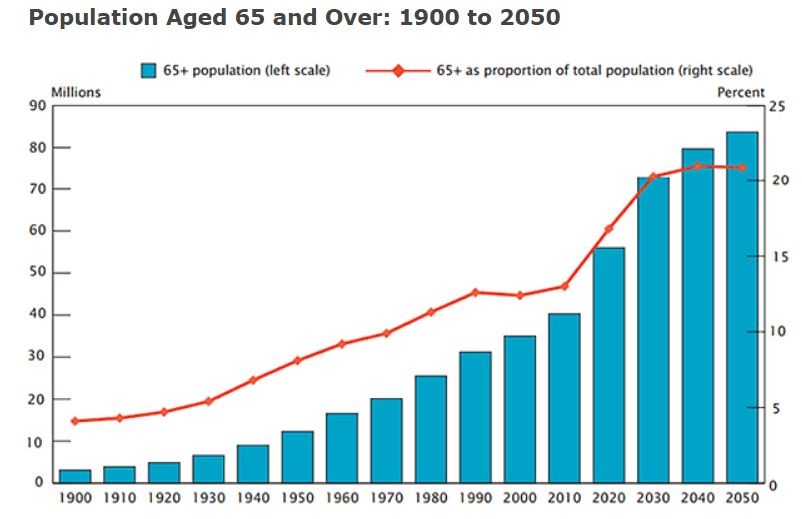

As of 2010, Americans who were 65 years of age or older represented 13 percent of the total U.S. population.[1] By the year 2030, this population is expected to grow to 19.3 percent of the population. Americans who have reached retirement age are one of the fastest growing demographics in this Country. Additionally, those that reach retirement age are expected to live longer than ever before. As of 2009, those Americans reaching the age of 65 had an average life expectancy of just over 18 years.[2] Not only is the population of Americans aged 65+ growing rapidly, but Americans that reach that age are living longer than ever as well.

Graph: National Center for Elder Abuse

This recent growth in the population of elderly in this country has exposed some troubling issues facing our aging Americans. Reports of elder abuse are rising amongst elderly Americans and some reporting agencies still believe instances of elder abuse are underreported, i.e. actual instances of elder abuse are higher than what is being reported to authorities.[3] Elder abuse can be defined as “physical, sexual, or psychological abuse, as well as neglect, abandonments, and financial exploitation of an older person by another person or entity, that occurs in any setting (e.g. home, community, or facility), either in a relationship where there is an expectation of trust and/or when an older person is targeted based on age or disability.”[4] As is often the case, the law protecting a growing, yet vulnerable, population such as the elderly does not grow as quickly as the population itself. Those out to make a quick, and unethical, profit may seek to take advantage of our elderly men and women, especially those with diminished capacities. Fortunately, there are legal avenues that loved ones can take when they believe that an elderly family member may have been the victim of financial exploitation.

INSTANCES OF FINANCIAL EXPLOITATION

Financial exploitation costs elderly Americans over $2.6 billion dollars annually.[5] The means by which an elderly person can be financially exploited by a family member or caretaker are numerous. Documented cases of adult abuse in Tennessee have ranged from one-time fraud resulting in the theft of several hundred dollars, to extensive exploitation ranging over years by a live-in caretaker. Often times, the exploitation takes the form of a “caretaker” exerting control over a loved one’s source of income, such as monthly Social Security or pension payments.

In 2015, a case of documented elder abuse in Coffee County, Tennessee involved the abuse, neglect and financial exploitation of an elderly, disabled woman by the woman’s sister.[6] The Defendant was accepting Social Security payments for the victim, without providing the victim with any of the necessary support from the funds (daily food, clothing, etc.). The disabled sister was found living alone in a shed behind a burned trailer; the Defendant sister lived in a house down the street. Over the course of five years, the Defendant received more than $68,000 in benefits for the victim with no documentation as to what, if any amounts, were spent on support for the victim. When found by the authorities, the victim was locked in the one room “shed” without running water or food and appeared to have been in that state for several days.

A 2014 Tennessee case told a similar tale. A Defendant, who was a court-appointed caretaker of two mentally disabled adult victims, was brought up on charges in Clay County, Tennessee.[7] The Defendant had petitioned the Court and received Conservatorships for both victims, as the Defendant was living with the sister of one of the victims and the victims resided at his residence. Once the Defendant was granted a Conservatorship over the victims, he utilized their money to buy expensive items for his house and farm (new bedroom suite, tractor, feed for his cattle, etc.). All the while, the victims were kept in squalor in a trailer on the Defendant’s property, and forced to perform physical labor for free (among other horrible abuses). A federal Court, sitting in Nashville, ultimately ruled that the Defendant had defrauded his victims of over $105,000.

WHAT CAN BE DONE IF YOU BELIEVE A LOVED ONE HAS BEEN FINANCIALLY EXPLOITED

So what can be done if you believe a loved one is being or has been financially exploited by a caretaker? Generally, fraud or financial exploitation regardless of the age of the victim are criminal matters and a local district attorney and police department can bring criminal charges against the caretaker. However, you can pursue additional legal remedies for your loved one in a civil proceeding. You may need to contact an attorney to remove whatever rights and privileges have been bestowed upon the caregiver that is exploiting your loved one. Additionally, there are specific means by which an attorney can seek to recover the money, property or items which have been wrongfully taken from your loved one.

In 1999, the Tennessee law makers amended the Tennessee Adult Protection Act (“TAPA”) to allow a private right of action on behalf of a disabled or elderly adult against a caretaker who has abused, neglected or defrauded them.[8] This action provides special protections for elderly victims and penalties against any wrongdoer who abuses, neglects or defrauds an elderly victim. This right of action does not extinguish if the victim were to pass away, and an action under the TAPA can recover certain categories of costs and expenses that are normally unavailable to an injured plaintiff.

As the amount and prevalence of elder abuse has vastly outpaced the awareness that we have for the protections available to elderly victims in these instances, the family and friends of elderly victims seldom seek out all available legal avenues of recovery for their elder loved ones. If you believe that a loved one has been the victim of abuse, fraud, theft or any sort of financial exploitation by someone in a caretaker role, whether an individual or a healthcare facility, please call the attorneys at Wolff Ardis. Wolff Ardis has been prosecuting fraud cases since our inception in 1988 and we’d be happy to discuss your concerns in a free consultation.

[1] AARP: A Profile of Older Americans: 2011

[2] Id.

[3] Quinn, K., & Benson, W. (2012). The states’ elder abuse victim services: a system in search of support. Generations 36(3), 66–71.

[4] U.S. Department of Justice, Department of Health and Human Services, Connolly, M.T., Brandl, B., & Breckman, R. (2014). The Elder Justice Roadmap:A Stakeholder Initiative to Respond to an Emerging Health, Justice, Financial and Social Crisis.

[5] MetLife Mature Market Institute, The National Committee for the Prevention of Elder Abuse, The Center for Gerontology at Virginia Polytechnic Institute and State University. Broken Trust: Elders, Family & Finances (PDF).

[6] State v. Carman-Thacker, No. M201400757CCAR3CD, 2015 WL 1881135 (Tenn. Crim. App., Apr. 24, 2015)

[7] Frankenfield v. Strong, No. 2:12-00054, 2014 WL 1234709 (M.D. Tenn., Mar. 25, 2014)

[8] T.C.A. § 71—6-120